In recent years, the insurance industry has gradually come into 2.0 era, the essence of online insurance relies on the new financial technology like big data and Blockchain, which can promote the rapid development of insurance Internet +, realizing the processes of Fintech automatic insurance, risk pricing and claim settlement. Therefore, Blockchain will play a role in all aspects of insurance industry, reduce the loss of fraud, automatic process with low costs, then to create a new business mode.Pain points are as follows:

- Identity authentication: Insurance company need to access a large number of C-users, spent lot on KYC( know your customer).

Blockchain solution: Blockchain company can provide the identity authentication by the third party, and there is no need for each institute to the KYC, saving the cost.

- Data loss, the single node is easy to be controlled: Insurance company owns a large of customer data, including insurance policies, customer privacy data, etc., the safety of database is critical. If the database is destroyed, the consequences will be disastrous.

Blockchain solution: Blockchain is the distributed and shared ledger, which can avoid the loss of single node collapse. Even if a database is damaged, the other data on other nodes can recover it. And the consensus mechanism of Blockchain can ensure the reality of accounting.

- Data security: Insurance company can obtain a large number of sensitive customer information during the process of underwriting and claims, such as identity, medical health, etc.

Blockchain solution:During the claim process, all the data will be extracted from the alliance chain of insurance company and hospital so that the sensitive information no longer need to be submitted to the insurance company, but only to be verified on Blockchain when needed. Meanwhile, Blockchain using symmetric encryption and authorized system, even the transaction on Blockchain is open, but only the authorized person can access to the data.

- High operation costs: The traditional insurance industry is driven by a series of manual operation: from the quote to apply, underwrite to compliance audit, and issue to loss message, each link needs the participation of person, leading to the high cost.

Blockchain solution: Smart contract: No need to apply for insurance claims, and without the settlement approcal of insurance companies, as long as the trigger claims condition, the automatic claims can pay the amount of claims. Of course, it can save the claim costs.

- Huge loss for fraud insurance

Blockchain solution: By the establishment of alliance chain on cross industry and cross regional, such as the Blockchain cooperation of hospital, traffice management departments and security departments, improve the verification efficiency of insurance cheating.

After solving the above traditional problems, Blockchain also brings new possibilities for the development of the insurance industry.

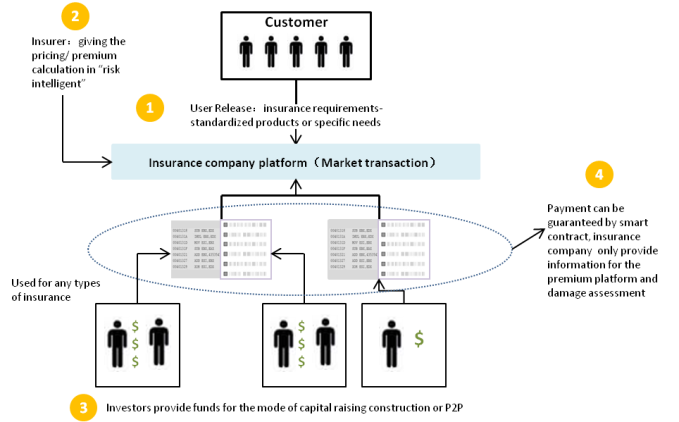

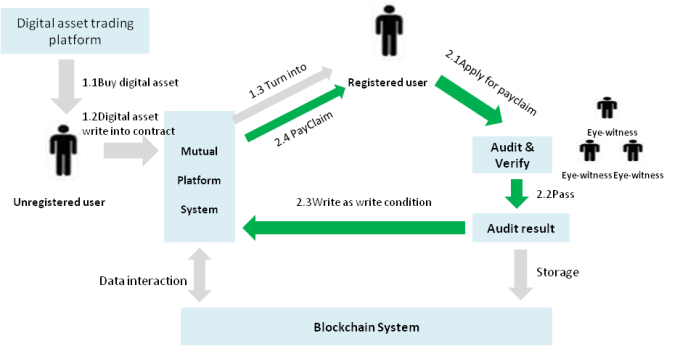

The above process shows the operating of Blockchain system. For the one thing, the data on the Blockchain are open and transparent, can not be forged, that is to say, each payment flow will be recorded on Blockchain and the investors can have a clear understanding of their premium flows, each user can monitor clearly. For another, all funds transformation will be executed by the smart contract, without man-made movement. And everyone’s sensitive information is encrypted, others cannot get through.

没有评论:

发表评论