Blockchain makes great changes on the existing financial compliance mode for anti-money laundering(AML) and understand customer (KYC).

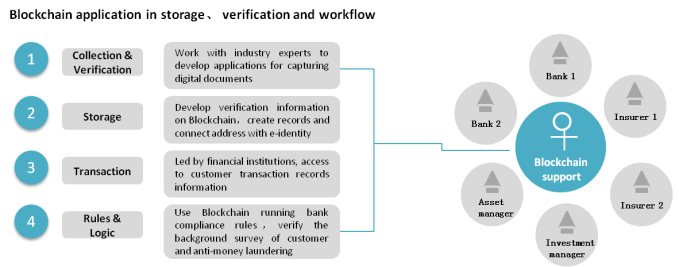

In the field of anti money laundering (AML), based on Blockchain, the financial institutions will collect and verify their customer’s digital information, then upload to Blockchain. At the same time, the financial institutions provide electronic identity information for trading entities (like private key), and connect users’ address with e-identity authentication information, any transaction should be verified by private key and public key of banks, and access to user address, which determines the traceability of data on the Blockchain. In such mode, all financial institutions will share transaction information on Blockchain, each part of any transaction will not be out of sight of money laundering supervision, which greatly enhance the efforts of anti money laundering. Of course, Blockchain can automatically verify the compliance of transaction and users by setting the rules and logic, the non-compliance of transaction and users will be removed, and the compliance degree of the whole financial enterprises will be greatly improved.

In the field of understanding customer (KYC), the financial institutions can share the transaction entity information through Blockchain, which will reduce a lot of repetitive work, meanwhile, save the compliance costs for each institution.

没有评论:

发表评论