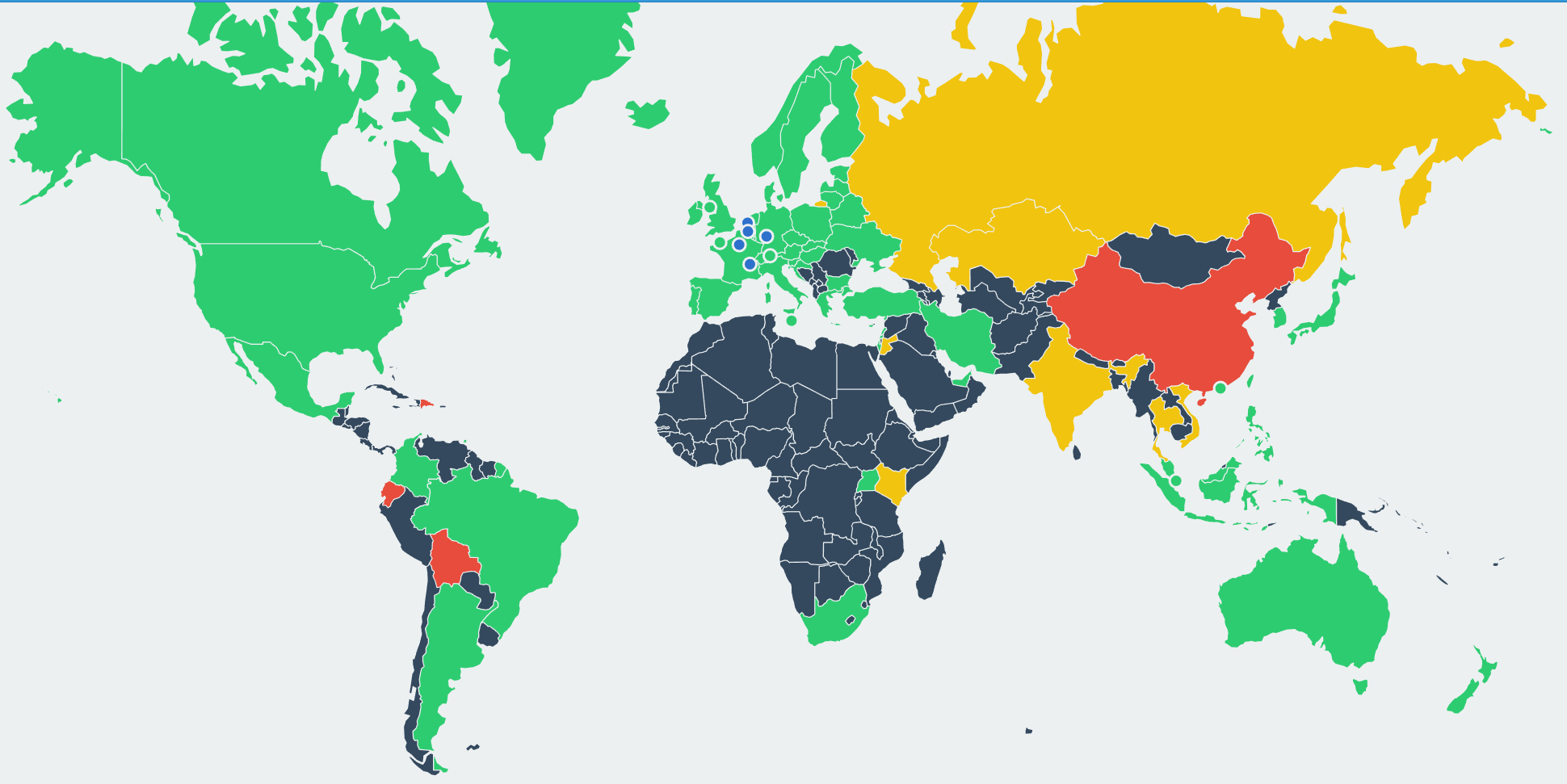

The peer-to-peer digital currency Bitcoin made its debut in 2009 and with it ushered in a new era of cryptocurrency. Today, there are more than 500 different cryptocurrencies to choose from, but Bitcoin still enjoys the first mover advantage. While tax authorities, enforcement agencies, and regulators are still exploring the phenomenon, one pertinent question is—is bitcoin legal or illegal? The answer is, it depends on the location and activity of the user.

Countries that Say Yes to Bitcoin

The fact that bitcoin can be anonymously used to conduct transactions between any account holders, anywhere and anytime across the globe, makes it attractive to criminal elements. They may use bitcoins to buy or sell illegal goods like drugs or weapons. Most countries have not clearly made determinations on the legality of bitcoin, preferring instead to take a wait-and-see approach. Some countries have indirectly assented to the legal usage of bitcoins by enacting some regulatory oversight. However, bitcoin is never legally acceptable as a substitute for a country’s legal tender.

The United States

The United States has taken a generally positive approach towards bitcoin. At the same time, it has several government agencies working on preventing or reducing the use of bitcoin for illegal transactions. Prominent businesses like Dish Network (DISH), Dell, and Overstock.com(OSTK) welcome payment in bitcoin. The digital currency has also made its way to the U.S. derivatives markets, which speaks about its increasingly legitimate presence.

The U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) has been issuing guidance on bitcoin since the beginning of 2013. The Treasury has defined bitcoin not as currency, but as a money services business (MSB). This places it under the Bank Secrecy Act which requires exchanges and payment processors to adhere to certain responsibilities like reporting, registration, and record keeping. In addition, bitcoin is categorized as property for taxation purposes by the Internal Revenue Service (IRS). (Related Bitcoin: Current And Future Legal Framework)

Canada

Like its southern neighbor the United States, Canada maintains a generally bitcoin-friendly stance while also ensuring the cryptocurrency is not used for money laundering. Bitcoin is viewed as a commodity by the Canada Revenue Agency (CRA). This means that bitcoin transactions are viewed as barter transactions, and the income generated is considered as business income. The taxation also depends whether the individual has a buying-selling business or is only concerned with investing.

Canada considers bitcoin exchanges to be money service businesses. This brings them under the purview of the anti-money laundering (AML) laws. Bitcoin exchanges need to register with Financial Transactions and Reports Analysis Centre (FINTRAC), report any suspicious transactions, abide by the compliance plans, and even keep certain records. In addition, the Canadian government has tasked the Senate Banking Committee with drafting guidelines for the legislature of virtual currencies by July of 2015.

Australia

Australia allows entities to trade, mine, or buy bitcoin. The Australian Taxation Office (ATO) considers bitcoin transactions barter arrangement subject to appropriate taxes depending upon the use and user (full document).

The European Union

Though the European Union (EU) has followed developments in cryptocurrency, it has not issued any official decision on legality, acceptance, or regulation. In the absence of central guidance, individual EU countries have developed their own bitcoin stances. A few nations are allowing bitcoin while others are either undecided or issuing warnings.

In Finland, the Central Board of Taxes (CBT) has given bitcoin a value-added tax exempt status by classifying it as a financial service. Bitcoin is treated as a commodity in Finland and not as a currency. The Federal Public Service Finance of Belgium has also made bitcoin exempt from value added tax (VAT). In Cyprus, bitcoins are not controlled or regulated but are not illegal either. The Financial Conduct Authority (FCA) in the United Kingdom (UK) has a pro-bitcoin stance and wants the regulatory environment to be supportive of the digital currency. Bitcoin is under certain tax regulations in UK. The National Revenue Agency (NRA) of Bulgaria has also brought bitcoin under its existing taw laws. Germany is open to bitcoin; it is considered legal but taxed differently depending upon whether the authorities are dealing with exchanges, miners, enterprises, or users.

Countries That Say No to Bitcoin

While bitcoin is fairly welcomed in many parts of the world, there are few countries which are wary of bitcoin because of its volatility, decentralized nature, perceived threat to the current monetary system, and link to illicit activities like drug dealing and money laundering. Some of these nations have outright banned the digital currency while others have tried to cut off any support from the banking and financial system essential for its trading and usage.

Iceland

The island nation has been exercising stringent capital controls as a part of its monetary policies adopted after the global economic crisis of 2008. It seeks to protect the outflow of Icelandic currency from the country. Under the same pretext, foreign exchange trading with bitcoin is banned in Iceland as the cryptocurrency is not compatible with the country’s Foreign Exchange Act. Interestingly, a new cryptocurrency called Auroracoin has lauched out of Iceland. Its founders wished to create a viable alternative to the present Icelandic banking system.

Vietnam

From the beginning, Vietnam’s government and its state bank have maintained that bitcoin is a not a legitimate payment method. After a few initial rounds of public rejoinders against the use of bitcoin, Vietnam made it illegal for both financial institutions and citizens to deal in bitcoin. It links the cryptocurrency to criminal activities such as money laundering.

Bolivia

El Banco Central de Bolivia has banned the use of bitcoin and other cryptocurrencies.

Kyrgyzstan

Using bitcoin and altcoin as a payment form is illegal in Kyrgyzstan.

Ecuador

Bitcoin and other cryptocurrencies were banned in Ecuador by a majority vote in the national assembly. However, the nation has plans to create its own cryptocurrency in the future.

Russia

The legality of bitcoin in Russia is disputed. Russia’s Ministry of Finance is hoping to pass a law to ban bitcoin sometime this year.

China

All banks and other financial institutions like payment processors are prohibited from transacting or dealing in bitcoin. Individuals, however, are free to deal in bitcoin between themselves. Bitcoin culture is thriving in China. It continues to be one of the worlds larges bitcoin markets. (Related reading How Bitcoin Can Change The World)

The Bottom Line

Although Bitcoin is now five years into existence, countries still do not have explicit systems that restrict, regulate, or ban the cryptocurrency. The decentralized and anonymous nature of bitcoin has challenged many governments on how to allow legal use while preventing criminal transactions. Most countries are still analyzing ways to properly regulate the the cryptocurrency. Overall, bitcoin remains in a grey area as the technological leap has left lawmakers far behind.

Source:https://www.investopedia.com/articles/forex/041515/countries-where-bitcoin-legal-illegal.asp

Gifts for You

NO.1:【Free Recordkeeping】

NO.2:【Sign up for rewards】

Step 1: Enter into Baoquan.com, then sign up as a member of Baoquan.com

Step 2: Enter into “Account”, Click the fourth icon “”, enter “73FK3F”, then you can own the cash coupon “¥88”as rewards.

Notice: This cash coupon can be used in the services of download TEC(Trustworthy Electronic Certificate), e-data attestation, socialized verify.

NO.3:【Free Blockchain Reports】

Subscribe WeChat

Our website:https://www.baoquan.com/?lang=en

Contact us: js@baoquan.com